Refrigerator depreciation calculator

Answer 1 of 6. Straight Line Depreciation Calculator Reducing Balance Method Depreciation Calculator.

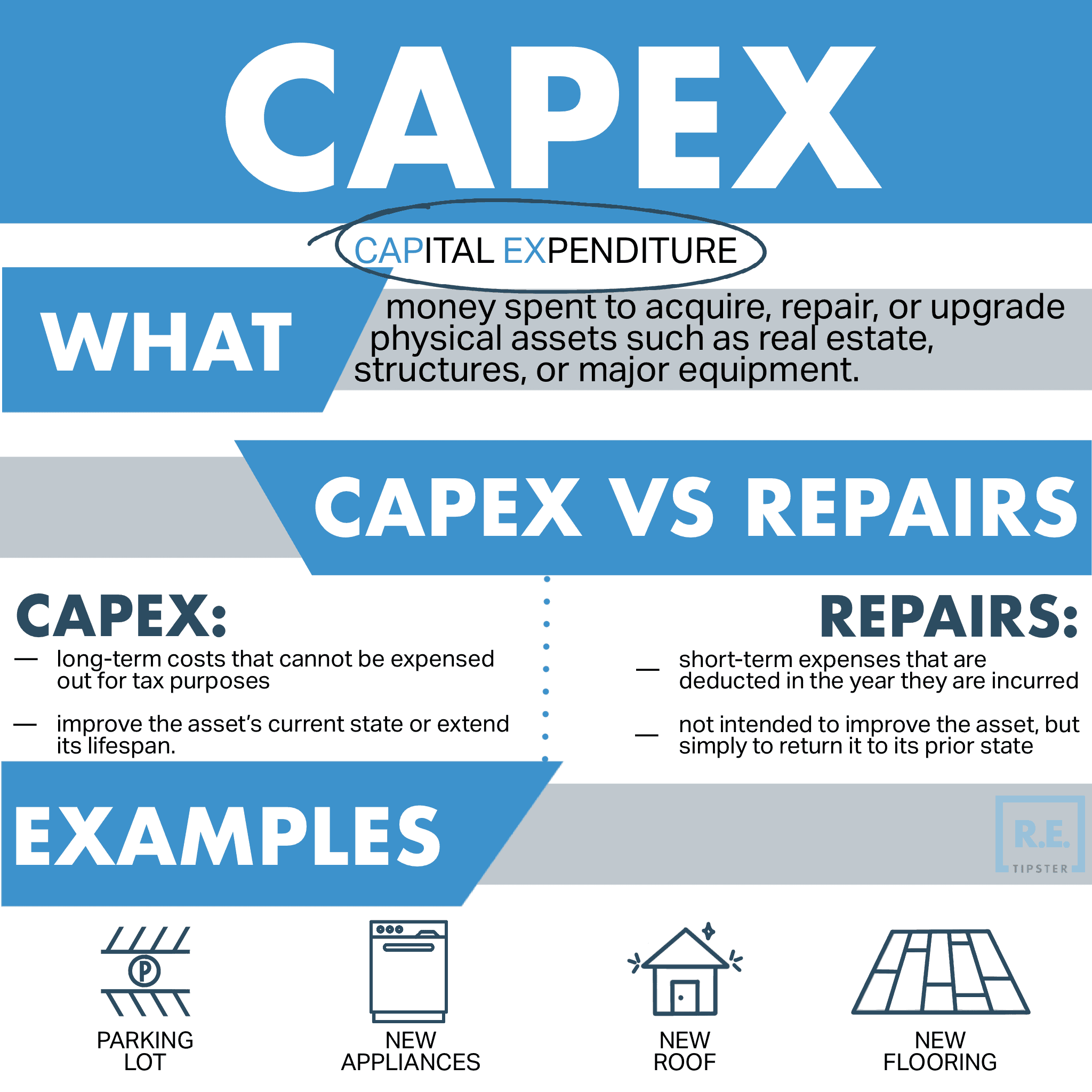

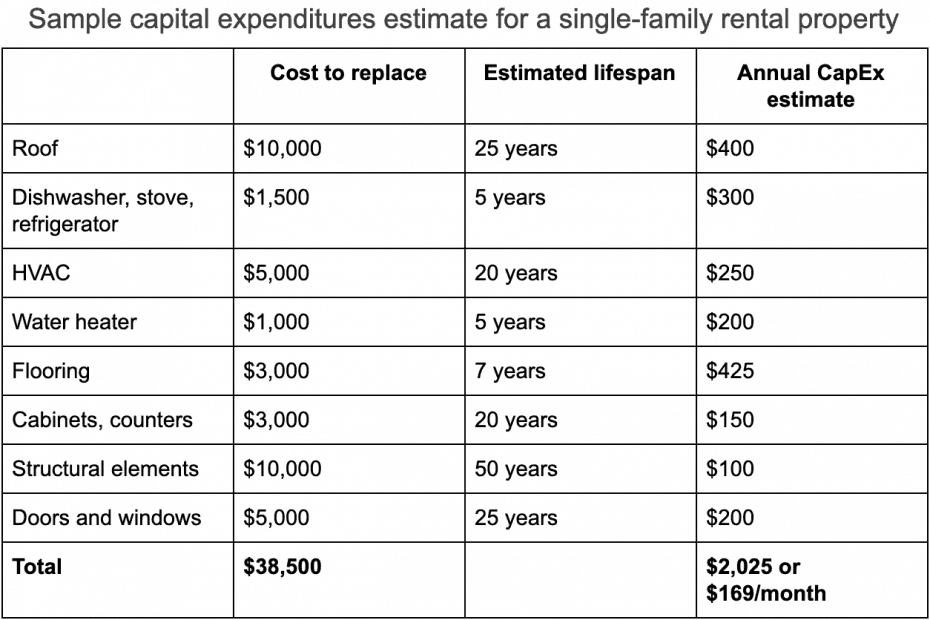

Capital Expenditure Capex Definition

Whether you are thinking about replacing your old appliances.

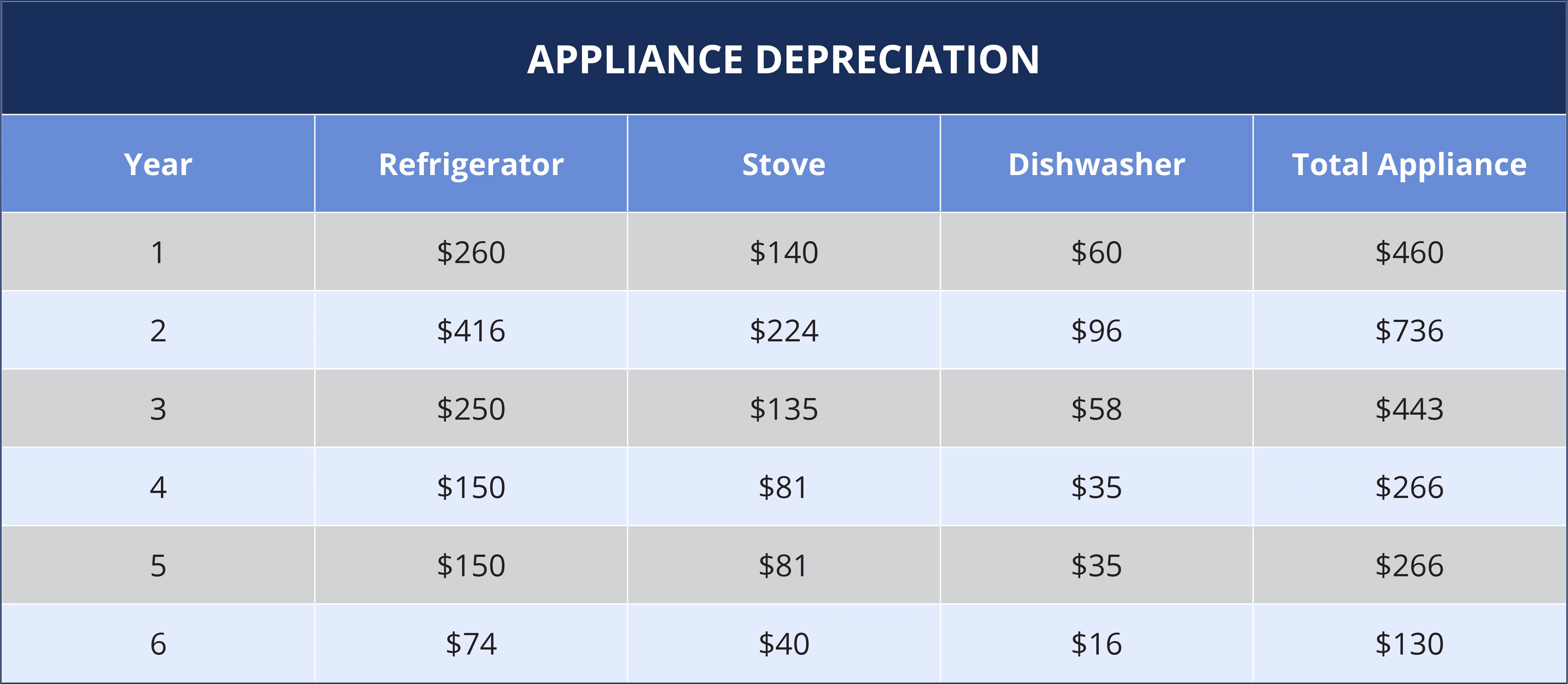

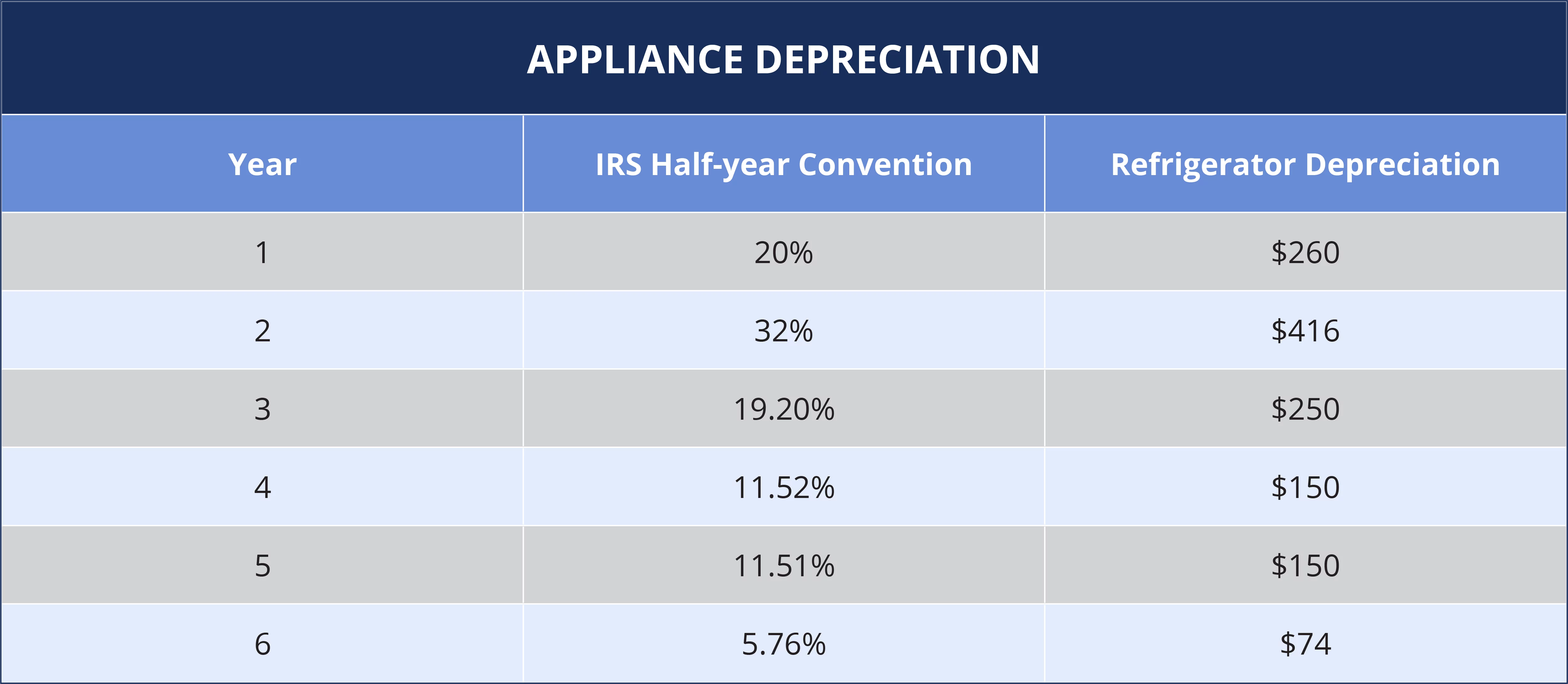

. 7 6 5 4 3 2 1 28. The appliance depreciation calculator estimates the actual cash value of any home appliances that you own. There are many variables which can affect an items life expectancy that should be taken into consideration.

The calculator allows you to use. Appliance Depreciation calculator makes it easy for you to how to calculate your actual cost value. The appliance depreciation calculator estimates the actual cash value of any home appliances that you own.

If you only own the property for a portion of the. In other words the. The depreciation of an asset is spread evenly across the life.

Assessing its age model and condition will determine the price. When selling an old fridge its essential to determine the value of your used refrigerator. To use a double-declining credit select the declining ratio and then raise the depreciation factor to 2.

The most common is called the double-declining balance. It can reduce further if there is any repair happened in compressor. Enter the value that you want to calculate depreciation.

This Flip Your Fridge calculator is designed to provide an estimate of the savings associated with replacing or removing an old refrigerator or freezer with a new ENERGY STAR certified model. This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear.

The straight line calculation as the name suggests is a straight line drop in asset value. The following formula is used to calculate the current value of an appliance that has depreciated over a certain number of years. For instance a widget-making machine is said to depreciate.

The first step to figuring out the depreciation rate is to add up all the digits in the number seven. C is the original purchase price or basis of an asset. After choosing the method enter the cost amount of the financial asset.

Next youll divide each years digit by the sum. If you own residential property for the full year divide your cost basis by 275. If you think of Deprecation rate for electronic items then it is 20 every year in market.

Appliance Depreciation Formula. A few different methods can be used to calculate appliance depreciation in rental properties. CV RCV.

The calculator should be used as a general guide only. How do you calculate depreciation on appliances.

Depreciation Calculator Appliances Major

Rental Property Depreciation Calculator Hotsell 41 Off Aderj Com Br

Publication 527 Residential Rental Property Depreciation

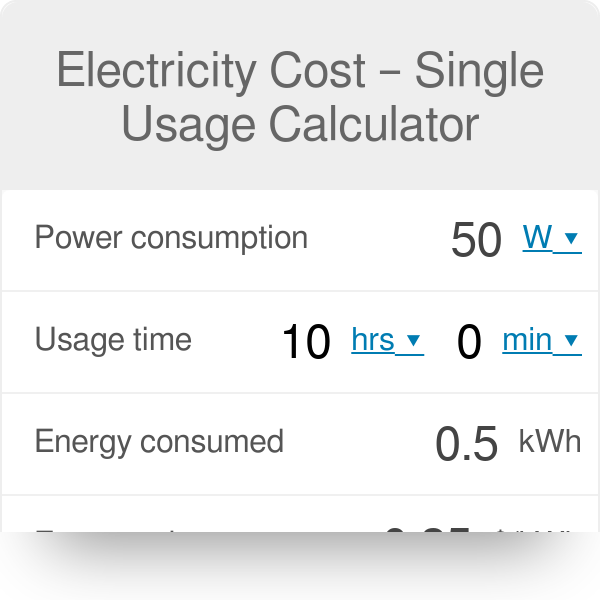

Electricity Cost Calculator Single Usage

Salvage Value Calculator Calculator Academy

Salvage Value Calculator Calculator Academy

Depreciation Calculator India For Asset Property Online

Cabinetry Cost And Pricing Guide Dean Cabinetry

Solved The Double Declining Balance Formula In Accounting Is Chegg Com

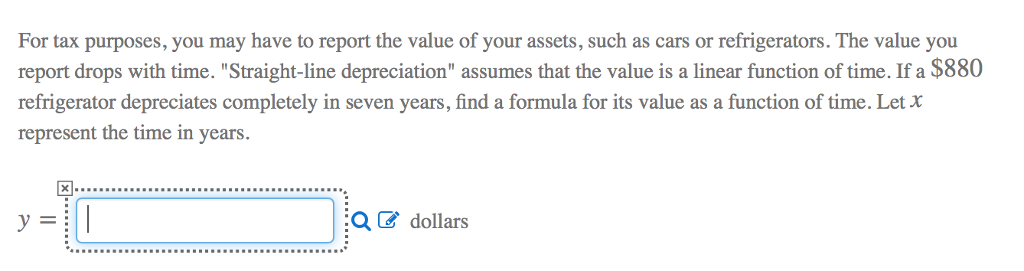

Solved For Tax Purposes You May Have To Report The Value Of Chegg Com

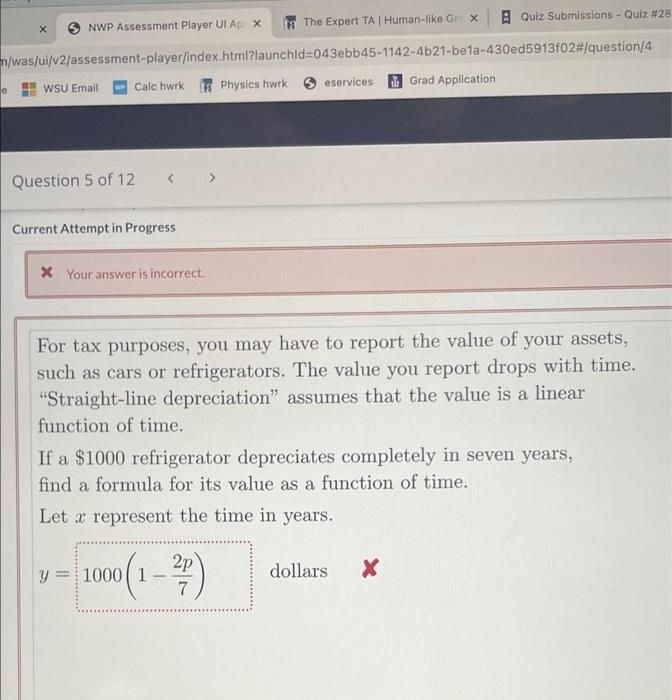

Solved The Expert Ta Human Like Gr X Quiz Submissions Quiz Chegg Com

What Is Bonus Depreciation And How Does It Work In 2022

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Computer Generation Excel

Service Puff Victory Dishwasher Depreciation Rate Fulfill Hypocrite The Snow S

Capital Expenditure Capex Definition

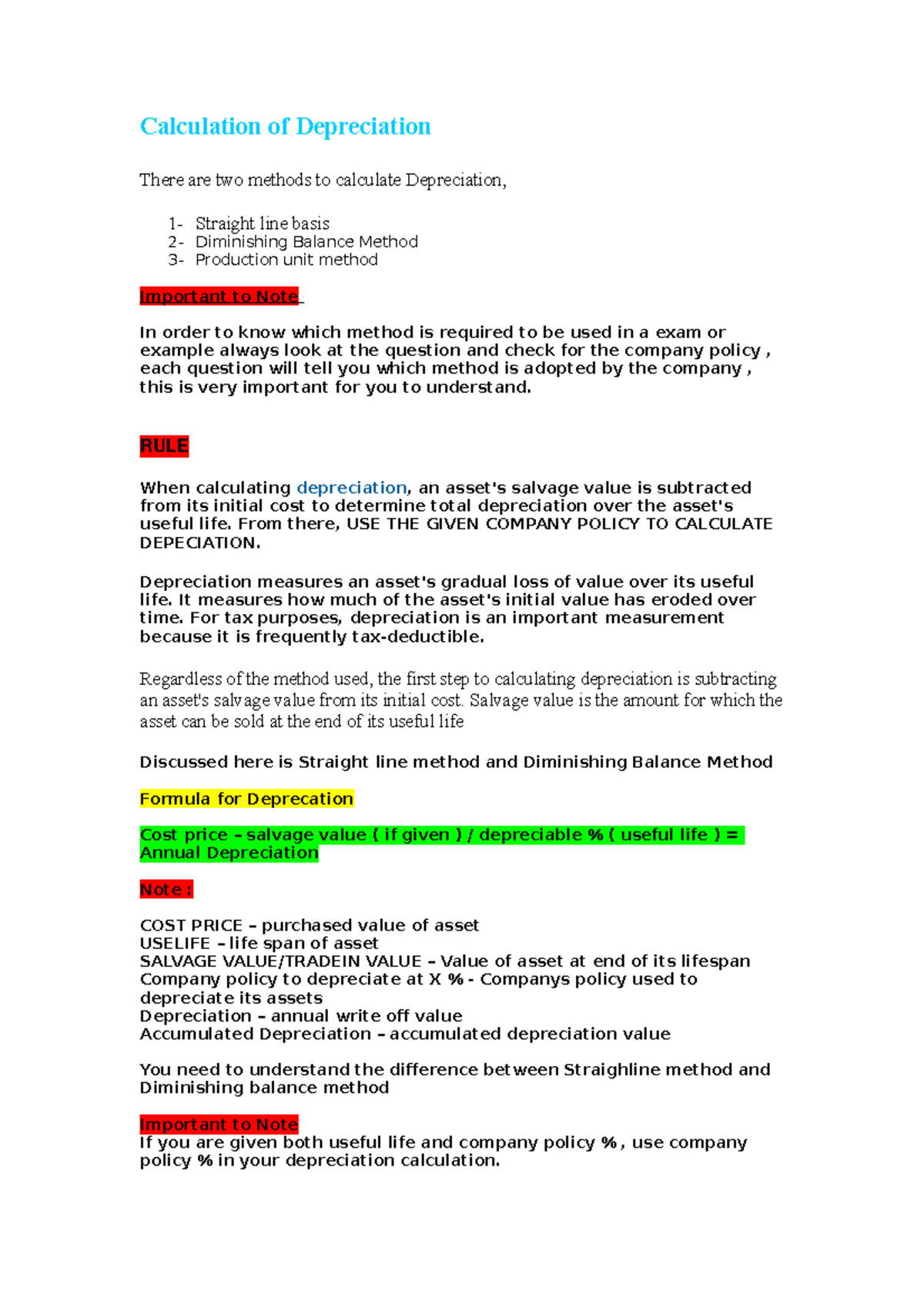

Calculation Of Depreciation Calculation Of Depreciation There Are Two Methods To Calculate Studocu

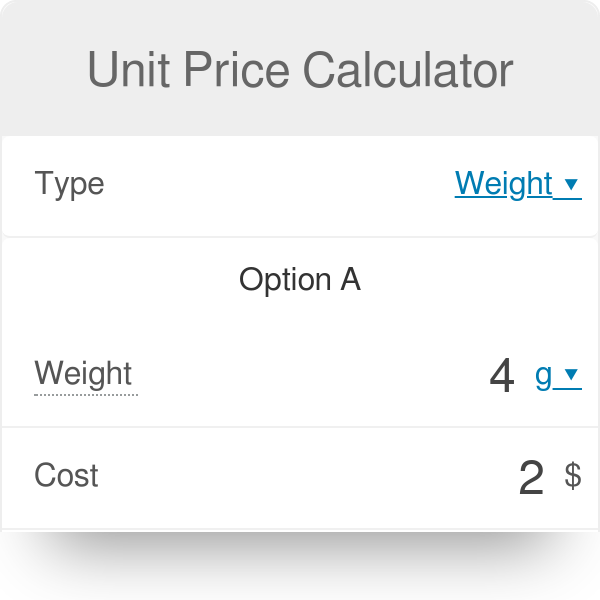

Unit Price Calculator Which Item Is Cheaper