Paycheck calculator with holiday pay

30 8 260 - 25 56400. With this option if an employee earns 15 per hour and they work an eight-hour day on a holiday they receive their holiday pay calculated as explained above plus 2250.

Free Paycheck Calculator Hourly Salary Usa Dremployee

Normal Per Hour Pay 8000 186 4301 Per Hour Number of hours not worked on day-off 6 hours.

. A full leave year. Ad Create professional looking paystubs. We use the most recent and accurate information.

Part of a leave year if the job started or finished part way through the year. First you need to determine your filing status. Utah Hourly Paycheck Calculator.

Just enter the wages tax. Important Note on Calculator. Calculation for a part-time worker For a part-timer it works on the same principle.

In a few easy steps you can create your own paystubs and have them sent to your email. Next divide this number from the annual salary. Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total.

The employer should use the method set out in Holiday pay. Make Your Payroll Effortless and Focus on What really Matters. Calculate public holiday pay Calculate public holiday pay Use this calculator to find out your pay for working on a public holiday falling on a working day or non-working day.

Normal per hour pay Last months salary Hours worked last month Holiday pay. The adjusted annual salary can be calculated as. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

The basics to calculate a weeks holiday pay. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general. Use this tool to calculate holiday entitlement for.

Texas paycheck calculator Payroll Tax Salary Paycheck Calculator Texas Paycheck Calculator Use ADPs Texas Paycheck Calculator to estimate net or take home pay for either hourly or. Pennsylvania Paycheck Calculator Use ADPs Pennsylvania Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. 5 56 28 28 days holiday.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. If an employer has counted back over 104 weeks and has only. Ad Compare Prices Find the Best Rates for Payroll Services.

Multiply the days in a normal working week for you by 56 So if you work 3. There are five main steps to work out your income tax federal state liability or refunds. Calculate your paycheck in 5 steps.

Hourly Paycheck Calculator Calculate Hourly Pay Adp

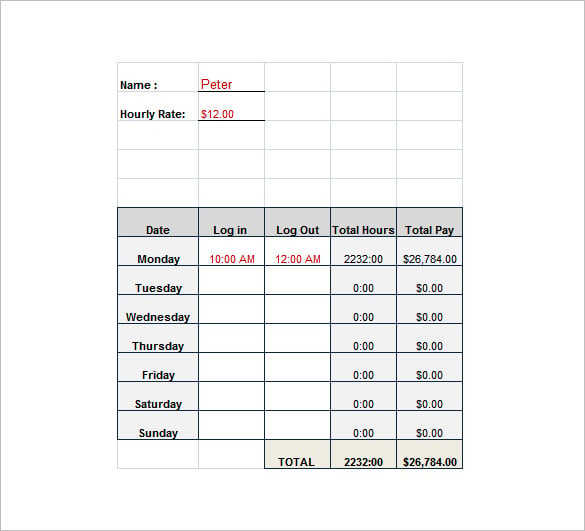

Payroll Calculator Free Employee Payroll Template For Excel

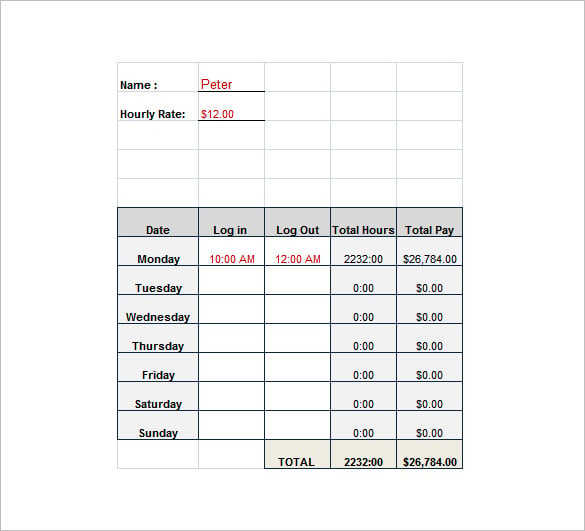

Payroll Calculator Free Employee Payroll Template For Excel

Paycheck Calculator Amazon Com Appstore For Android

Free Online Paycheck Calculator Calculate Take Home Pay 2022

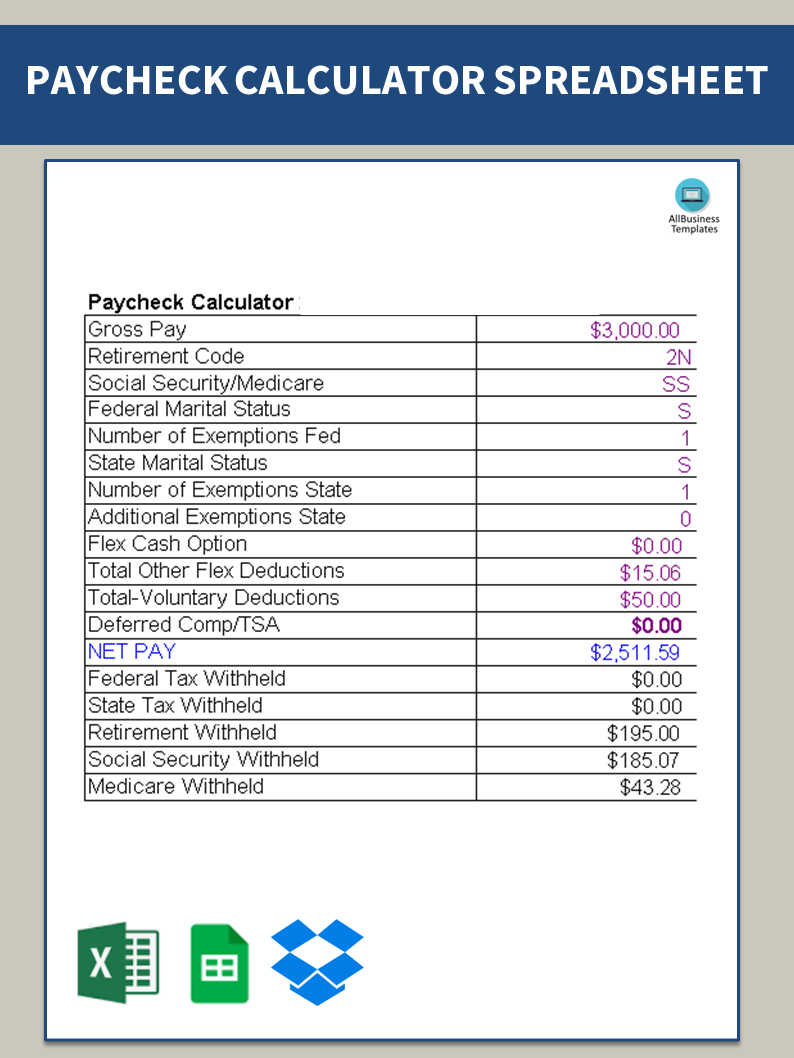

Paycheck Calculator Templates At Allbusinesstemplates Com

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

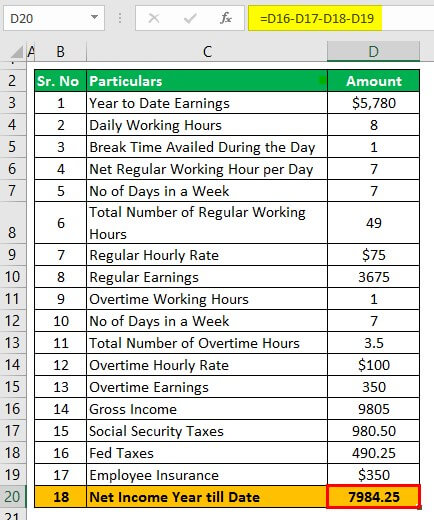

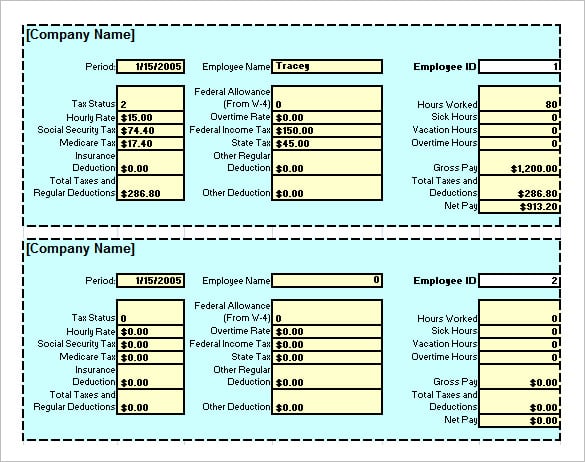

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

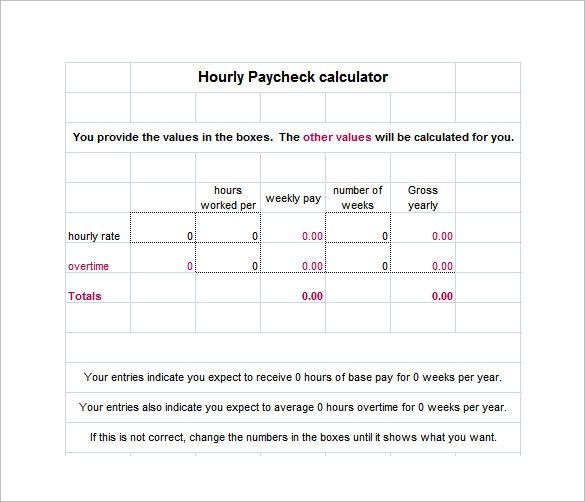

Hourly Paycheck Calculator Step By Step With Examples

Hourly Paycheck Calculator Step By Step With Examples

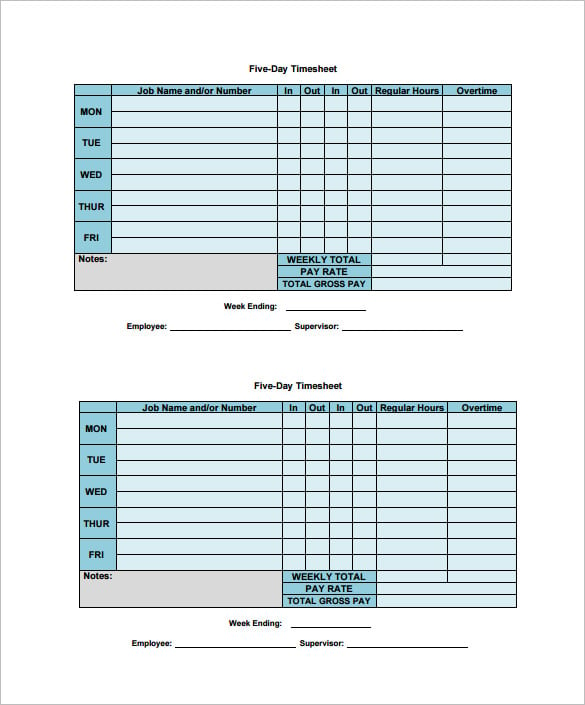

10 Free Hourly Paycheck Calculator Excel Pdf Doc Word Formats

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Payroll Calculator Free Employee Payroll Template For Excel

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

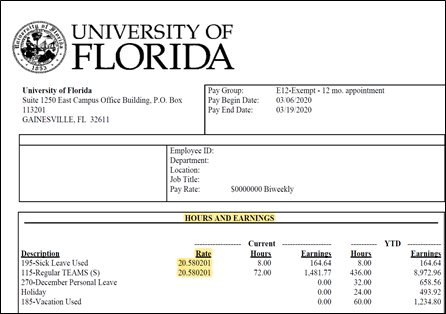

Efmlea Single Day Efm Calculator Uf Human Resources